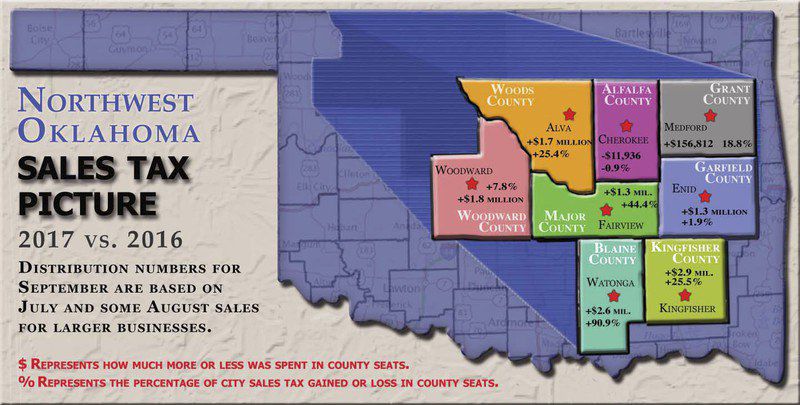

Retail sales are up in Enid and many other area county seats.

Oklahoma Tax Commission reports for September show Enid sales are up 1.9 percent, or $1.3 million, from sales reported in September 2016. Overall, year to date, retail sales are down 0.4 percent.

“I’m pleased to report that sales tax, excluding the new Kaw Lake portion, is up 3.18 percent over the same month last year, and up 2.22 percent for the first fiscal quarter compared to last year’s fiscal quarter. It is an encouraging sign of an improving economy,” City Manager Jerald Gilbert said.

A report for Cherokee, in Alfalfa County, shows an $11,936, or 0.9 percent, decrease in net taxable sales, and year to date decrease of 4.4 percent.

Fairview, located in Major County, has a $1.3 million, or 44.4 percent, increase in net taxable sales, when compared to September 2016. Year to date, retail sales are up 21.9 percent.

Net taxable sales for Kingfisher, located in Kingfisher County, are up $2.9 million, or 25.5 percent. Year to date, sales are up 30.5 percent.

A report for Medford, in Grant County, shows a $156,812, or 18.8 percent, increase in net taxable sales. Retail sales, year to date, have decreased 1.6 percent.

Watonga, located in Blaine County, has a $2.6 million, or 90.9 percent, increase in retail sales. Year to date, sales are up 72.4 percent.

Net taxable sales for Woodward, located in Woodward County, are up $1.8 million, or 7.8 percent. Sales are up 1.9 percent year to date.

Sales tax revenue distributed this month is based on sales from late July and early August.

Story provided by: Enid News & Eagle

Written by: Jessica Miller