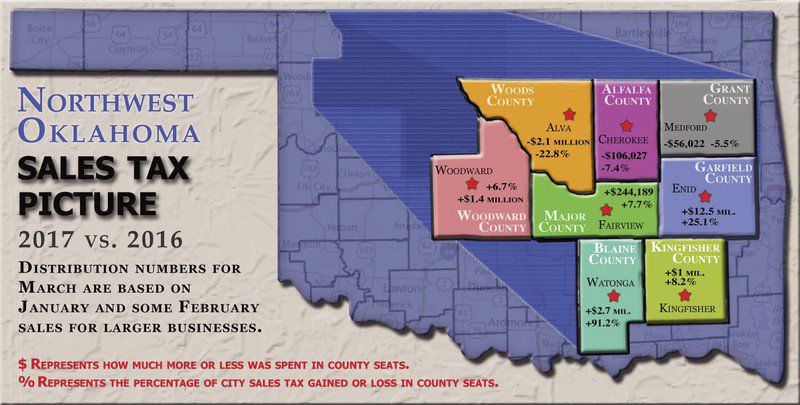

Retail sales are up for Enid and several other area county seats.

Oklahoma Tax Commission reports for March show Enid sales are $12.5 million more than sales reported in March 2016, and sales tax revenue increased by 25.1 percent for sales occurring mostly in the last half of January and estimated sales for the first half of February.

“The news this month is very positive. The big sales tax increase is due mostly to the additional three-quarter cent sales tax that was added on January 1 for the Kaw Lake project. When the impact of that is taken out of the increase, we still did experience an increase of 3.03 percent compared to the same period last year,” City Manager Jerald Gilbert said. “This increase is an encouraging economic sign given that sales tax has decreased monthly compared to the previous year in approximately 20 of the last 27 months. I am hopeful that the economy may be bottoming out and poised for a rebound in the near future. Additionally, Amazon has agreed to begin collecting sales tax March 1 and we will see the impact of that beginning in May. Enid has been around for 123 years and I look forward to the next 123 years.”

Fairview, located in Major County, has a $244,189 increase in net taxable sales, when compared to March 2016. Sales tax revenue increased by 7.7 percent.

Net taxable sales for Watonga, located in Blaine County, are up $2.7 million. Sales tax revenue is up 91.2 percent.

Kingfisher, located in Kingfisher County, has a $1 million increase in net taxable sales. Sales tax revenue increased 8.2 percent.

Three area county seats have decreased retail sales.

A report for Cherokee, in Alfalfa County, shows a $106,027 decrease in net taxable sales, and a 7.4 percent decrease in sales tax revenue.

Alva, in Woods County, has a $2.1 million decrease in net taxable sales. Sales tax revenue is down 22.8 percent.

Story provided by: Enid News & Eagle

Written by: Jessica Miller