Retail sales in Enid were down in February, and in all but six months over the past two calendar years.

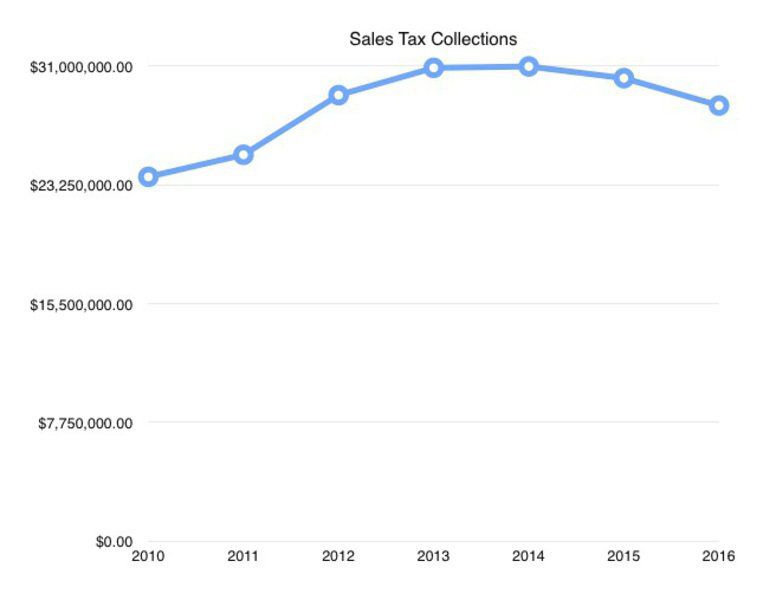

Despite the decrease in retail sales, and the subsequent drops in sales tax revenue for the city, numbers are still be higher than pre-oil boom levels.

Furthermore, this fiscal year is actually projected to be the fifth highest for sales tax collections the city has ever had, Chief Financial Officer Erin Crawford said.

“Which even though we’re down, that’s still not bad,” City Manager Jerald Gilbert said.

The affect of oil

Crawford said she thinks increased oil activity was the biggest factor since 2011, and decreased oil activity resulted in recent sales tax revenue decreases.

While several officials at state agencies could not provide exact beginning and ending dates for the oil boom in the area, Oklahoma Geological Survey Director Jeremy Boak estimated it occurred before 2013 and probably back to 2011.

Total sales tax collections for Enid in calendar year 2010 were $23.4 million. Collections have been higher in calendar years since, before dropping from $30.2 million in 2015 to $28.4 million in 2016.

Continued growth in Enid is believed to be the cause for not seeing deeper drops in sales tax revenue, Crawford said.

“You can see that by all the new locations that have opened, and chosen to open retail locations here in Enid,” she said.

In looking back at 15 years of data, if averaged out, the city is at a 2.5 percent growth rate — average per year — from that timeframe, Crawford said.

“It’s just continued improvement in the economy in Enid,” she said.

Hotel occupancy rates, according to STR reports and a Travel Research Study that Visit Enid commissioned through Young Strategies, were at 56.6 percent in 2010. Rates were higher — at 69 percent in 2011, 78.1 percent in 2012, 69.8 percent in 2013, 66.1 percent in 2014 and 58.2 percent in 2015 — before dropping to 51.9 percent in 2016.

‘We’ve been blessed with some oil activity’

While Enid and a number of other area county seats have seen declines in recent months in sales tax revenue — when compared to the same period of the previous year — two county seats have routinely had increases.

“We’ve been blessed with some oil activity in the area,” city of Watonga Treasurer Rodney Jacks said. “That’s all it is.”

There is no new retail, he said.

Through the Oklahoma Tax Commission website, Jacks has been able to narrow down where the money is coming from, and “it’s been oilfield-related,” he said.

One month, the city got a $110,000 jump from one company, Jacks said.

“This last one that we just got booked, I think there was one oilfield-related company that bumped it up about $80-some thousand,” he said. “Yeah, it’s oil-related, and I hope it keeps going. I really do.

“A lot of towns are having decreases, and we’ve been blessed that we haven’t.”

City of Kingfisher Treasurer Anita James does not know what to attribute increased sales tax collections.

“Our house building is going pretty good. I don’t know if that’s what caused it over the winter months. We really don’t know exactly, for sure, what’s doing it. We’ve been happy to receive it, but really don’t know a way, or haven’t tried to pinpoint where it’s coming from,” she said.

‘I think we’re doing good’

Online sales could also be impacting local sales tax collections, Gilbert said.

“I’m happy that Amazon is voluntarily collecting. I’m happy that (Rep.) Chad Caldwell helped champion the Retail Protection Sales Tax Act, and we hope that more people will follow because, in this day and age, buying stuff, a lot of people do it online,” he said.

Gilbert noted Enid is the “hub of Northwest Oklahoma.”

“I think we’re doing good. I think, obviously, I’d like to see the sales tax trend go up again but I think that there’s been a general decline, not just oil and gas, I think agriculture’s a little depressed right now. I think, hopefully, we’re going to see some positive results from the Amazon deal. We’ve had some new stores open, notably the Academy and some of the stores related to it, so hopefully we’ll see some improvement there,” he said.

There’s been job growth, and the housing market has grown, Crawford said.

“That all comes into play with medical and then the support of bonds for the schools as well. All of that has to work together to make the economy continue to grow,” she said.

Although sales tax collections have been down in Enid, officials know the situation will turn around sometime, Gilbert said.

“We believe in Enid, I believe in Enid, I think everybody else does. I think that’s why you see some of the activity (Crawford) talked about. We just need to hang in there together and continue to make things better for everybody, and appreciate everybody’s efforts — the developers that are doing the things they’re doing that believe in Enid, the people that live here that believe, the industries,” he said, adding Transportation Partners and Logistics has come to Enid, and Koch has made a major investment in the economy. “I believe in Enid.”

Story by: Enid News & Eagle

Written by: Jessica Miller