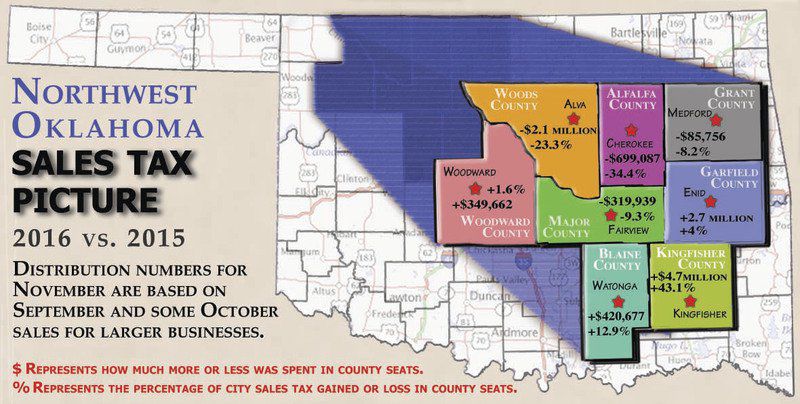

After six consecutive months of declines, retail sales in Enid are up. Oklahoma Tax Commission reports for November show Enid sales are $2.7 million more than sales reported in November 2015, and sales tax revenue increased by 4 percent for sales occurring mostly in the last half of September and estimated sales for the first half of October. “I am pleased to see this positive sign that our economy is improving. I am hopeful with the Christmas season upon us, we will continue to see improvement in the sales tax numbers,” City Manager Jerald Gilbert said. Overall receipts for this year show a 5.9 percent decrease in sales tax revenue and a $46.7 million decrease in net taxable sales, when compared to receipts for the first 11 months of 2015.

Area county seats had mixed reports. A report for Medford, in Grant County, shows an $85,756 decrease in net taxable sales, and an 8.2 percent decrease in sales tax revenue. Net taxable sales for Cherokee, in Alfalfa County, are down $699,087. Sales tax revenue decreased by 34.4 percent. Alva, located in Woods County, has a $2.1 million decrease in net taxable sales, when compared to November 2015. Sales tax revenue decreased by 23.3 percent. Woodward, in Woodward County, has a $349,662 increase in net taxable sales. Sales tax revenue is up 1.6 percent. A report for Fairview, in Major County, shows a $319,939 decrease in net taxable sales, and a 9.3 percent decrease in sales tax revenue. Net taxable sales for Watonga, located in Blaine County, are up $420,677. Sales tax revenue is up 12.9 percent. Kingfisher, located in Kingfisher County, has a $4.7 million increase in net taxable sales. Sales tax revenue increased 43.1 percent.

Story by: Enid News & Eagle

Written by: Jessica Miller