Retail sales are up in Enid following six consecutive months on a downward trend.

“This is welcome news and, hopefully, a sign of more good things to come,” City Manager Jerald Gilbert said.

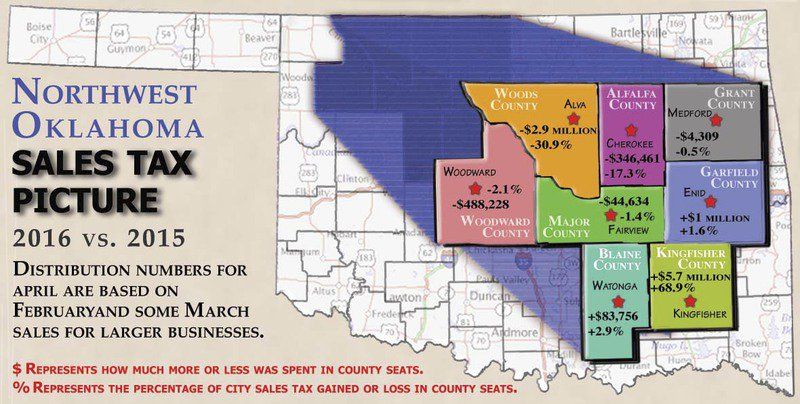

Oklahoma Tax Commission reports show sales are $1 million more than sales in April 2015, and sales tax revenue increased by 1.6 percent for sales occurring mostly in the last half of February and estimated sales for the first half of March.

Overall receipts for this year show an 8 percent decrease in sales tax revenue and a $23.9 million decrease in net taxable sales, when compared with receipts for the first four months of 2015.

Reports show net taxable sales for Medford, the Grant County seat, are down $4,309. Sales tax revenue decreased by 0.5 percent.

Cherokee, located in Alfalfa County, has a $346,461 decrease in net taxable sales. Sales tax revenue decreased by 17.3 percent.

A report for Alva, in Woods County, shows a $2.9 million decrease in net taxable sales, and a 30.9 percent decrease in sales tax revenue.

In Woodward, the Woodward County seat, net taxable sales are down $488,228 when compared with April 2015. Sales tax revenue is down 2.1 percent.

Fairview, located in Major County, has a $44,634 decrease in net taxable sales, and a 1.4 percent decrease in sales tax revenue.

The only other two area county seats to have increases were Watonga and Kingfisher.

Watonga, located in Blaine County, has an $83,756 increase in net taxable sales, and a 2.9 percent increase in sales tax revenue.

In Kingfisher, located in Kingfisher County, net taxable sales are up by $5.7 million, when compared with April 2015. Sales tax revenue is up 68.9 percent.

Story by: Enid News & Eagle

Written by: Jessica Miller